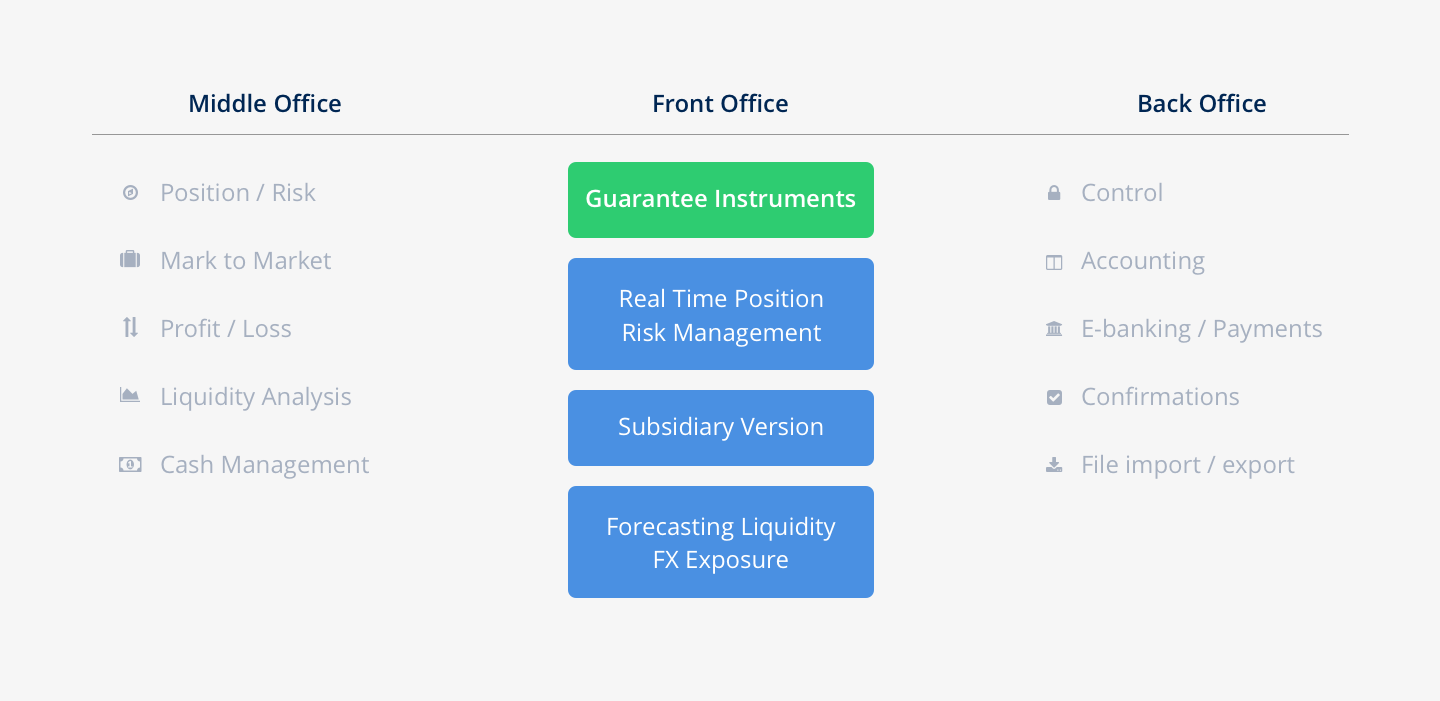

CRM Finance basic functionality

The CRM Finance basic functionality in Front-, Middle-, and Back office is applied equally for all instruments covered in multi-currency and multi-user environments. The system is designed to meet the needs of the treasury department for real-time analysis of position, risk, profit and loss and sensitivity.

Automated accounting

The CRM function for dynamic automated account coding cuts the time and effort necessary for setup and maintenance of the accounting function to a minimum. The function is operative within a few days and is entirely multi-currency based.

Manual accounting is available for non-standard situations. Journal entries are exported to your ERP system.

CRM supports transactions in all below IR categories:

|

|